In a recent blog, we highlighted the growing unease in the markets regarding the appetite for US Treasuries (USTs). This apprehension stems from several factors: the potential impact of Trump's tariffs, the uncertain direction of US fiscal policy, ambiguity surrounding Federal Reserve (Fed) policy and the scale of UST issuance. Despite these concerns, we argued that fears of a buyers' strike for USTs were overstated. The market's diverse and deep buyer base, coupled with a mix of global economic and geopolitical risks, suggested that investors would remain engaged.

Just one month later, the Trump administration's imposition of more aggressive tariffs than initially anticipated has triggered a substantial surge in demand for USTs, leading to a pronounced decline in yields across the curve. This development is hardly unexpected, given that USTs are universally regarded as safe-haven assets with few viable alternatives. In times of market turbulence, USTs typically see higher demand, resulting in increased prices and lower yields. This phenomenon is further underscored by the enduring status of the US dollar as the world's primary reserve currency, despite escalating international apprehensions regarding the reliability of the US under Trump's confrontational foreign policy approach.

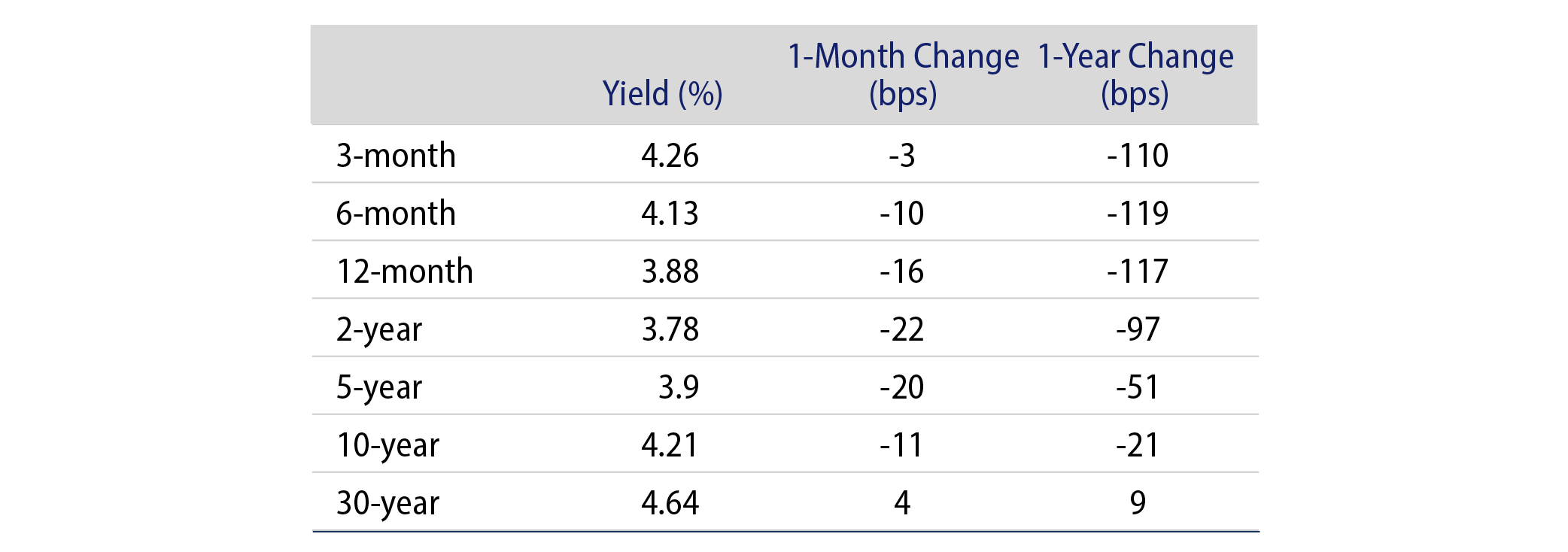

However, it's crucial to recognize that not all UST securities offer the same experience. Long-term USTs are susceptible to liquidity and interest-rate risks, which can result in substantial rate volatility during periods of heightened uncertainty regarding economic growth and inflation, as we are currently experiencing. Conversely, short-term USTs, such as Treasury bills, are more directly influenced by Fed policy and consequently exhibit significantly lower rate volatility due to their reduced exposure to liquidity and interest-rate risks. Exhibit 1 highlights the outperformance of shorter-term USTs compared to their longer-term counterparts over both one-month and one-year periods.

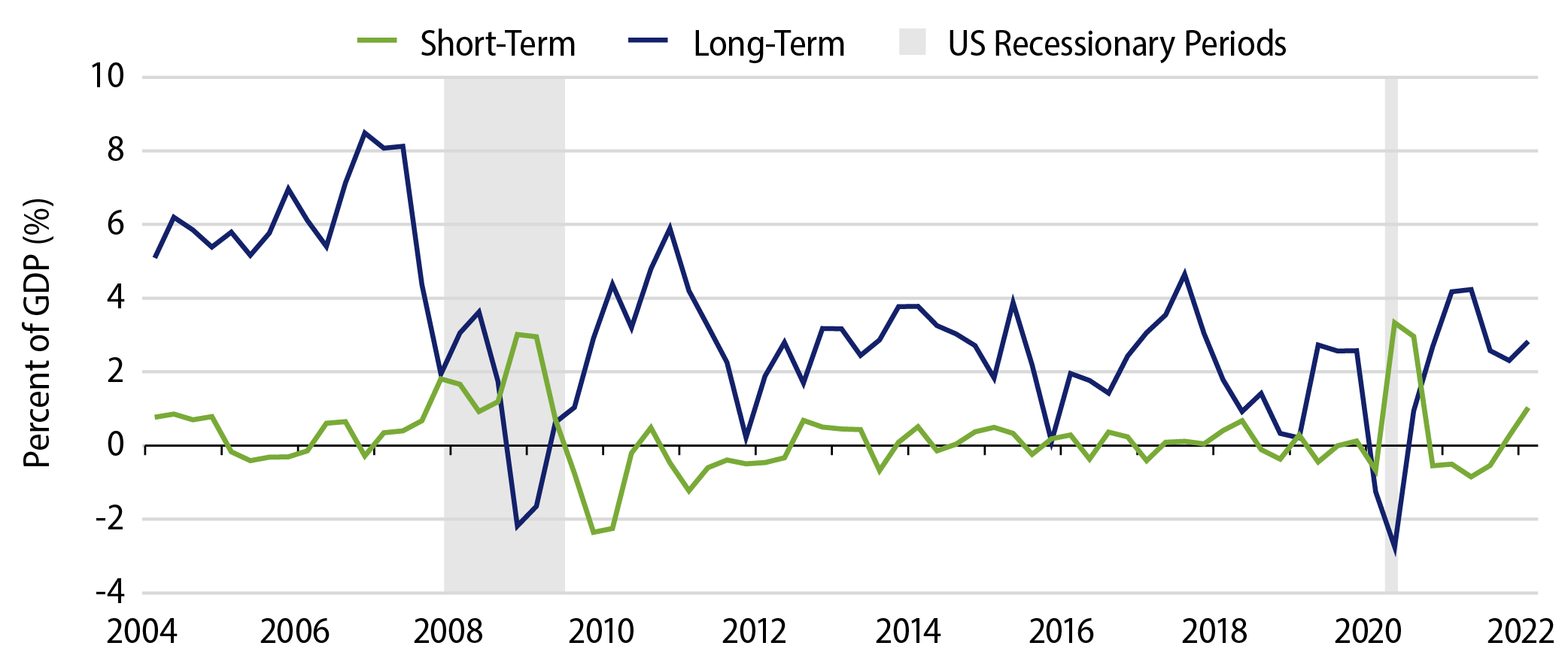

This trend can be better understood by examining flow activity from a long-term perspective. Historical financial data reveals that during periods of crisis, investors prioritize safety and liquidity, gravitating toward short-term USTs. Exhibit 2 illustrates the inflows into short- and long-term USTs over the past two decades. Notably, during the 2007-2009 global financial crisis and the onset of the Covid pandemic in early 2020, inflows to long-term USTs declined while inflows to short-term USTs surged.

Looking ahead, we believe that shorter-maturity bonds and money market funds (MMFs) will provide investors with a reasonable cushion during this period of uncertainty related to the Trump tariffs. Shorter-maturity bonds stand to benefit from any Fed easing, with yields less prone to fluctuations due to shifting longer-term growth and inflation expectations. Meanwhile, MMFs can mitigate the decline in yields following Fed rate cuts by extending the weighted average maturity of their portfolios. This makes MMFs more attractive compared to other cash-equivalent alternatives such as short-term bank certificates of deposit.

In conclusion, while the market's initial concerns about UST appetite remain valid, the recent surge in demand for these securities during the current global financial market downturn underscores their enduring appeal as safe-haven assets. That stated, investors should remain mindful of the varying levels of comfort offered by different types of UST securities and consider the benefits of shorter-maturity bonds and MMFs while navigating the current economic landscape.