Municipals Posted Negative Returns During the Week

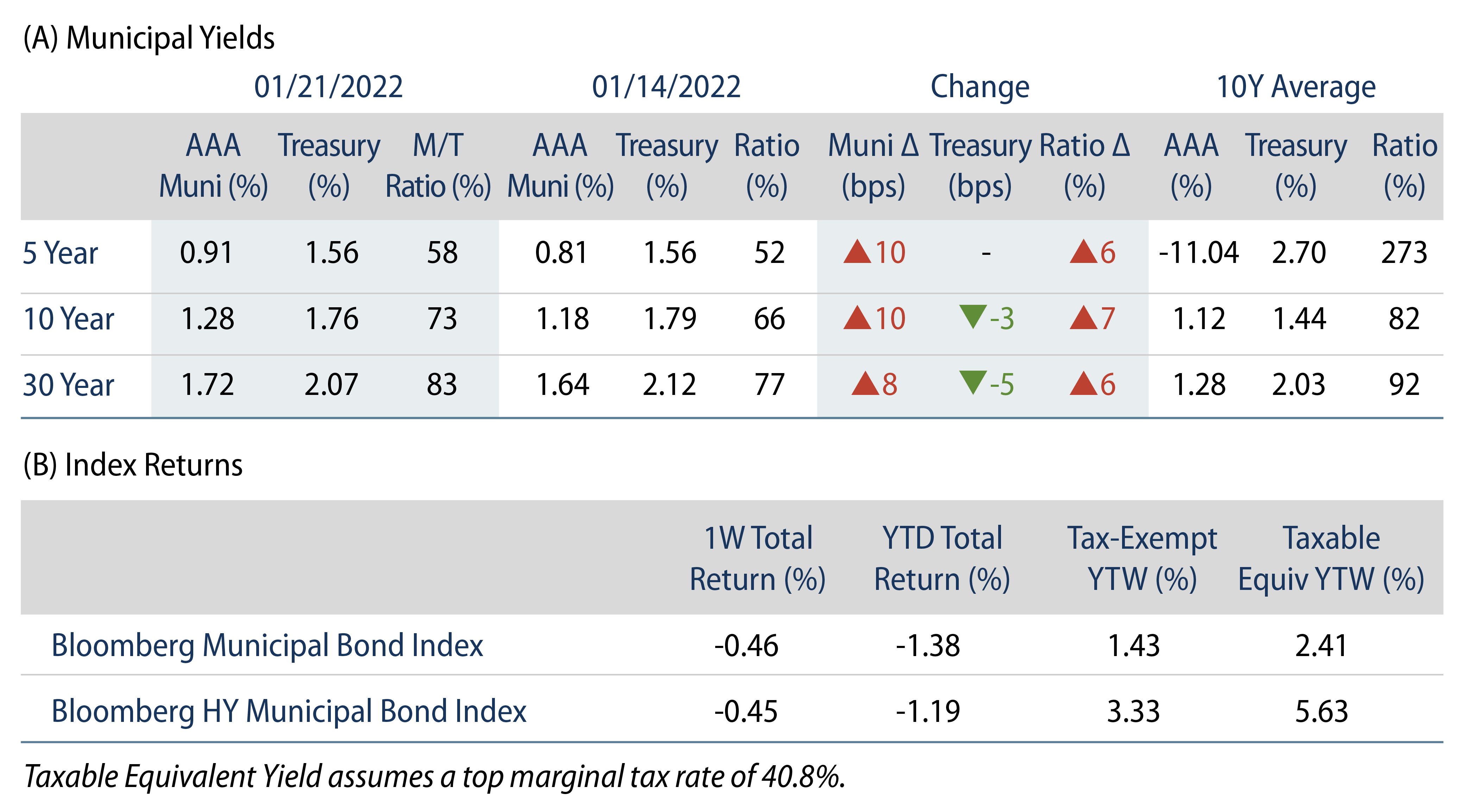

US municipals posted negative returns and underperformed Treasuries this week. High-grade municipal yields moved 8-10 bps higher across the curve. Municipal mutual fund flows turned negative, ending the 45-week inflow streak. The Bloomberg Municipal Index returned -0.46%, while the HY Muni Index returned -0.45%. This week we highlight progress around Puerto Rico’s record debt restructuring plan.

Municipal Technicals Remained Supportive

Fund Flows: During the week ending January 19, municipal mutual funds recorded $239 million of net outflows, according to Lipper. However, long duration and high-yield funds retained demand. Long-term funds recorded $426 million of inflows, high-yield funds recorded $182 million of inflows and intermediate funds recorded $71 million of outflows. The week’s outflows end the streak of 45 consecutive weeks of net inflows into weekly reporting municipal mutual funds. Net inflows year-to-date (YTD) remain positive at $338 million.

Supply: The muni market recorded approximately $8 billion of new-issue volume, down 19% from the prior week. Total YTD issuance of $20 billion is over 2x higher from last year’s levels, with tax-exempt issuance trending 2.4x higher year-over-year (YoY) and taxable issuance trending 15% higher YoY. This week’s new-issue calendar is expected to remain steady at $7.8 billion. The largest deals include $894 million Brightline West Passenger Rail and $749 million Airport Commission of the City and County of San Francisco transactions.

This Week in Munis—Puerto Rico Progress

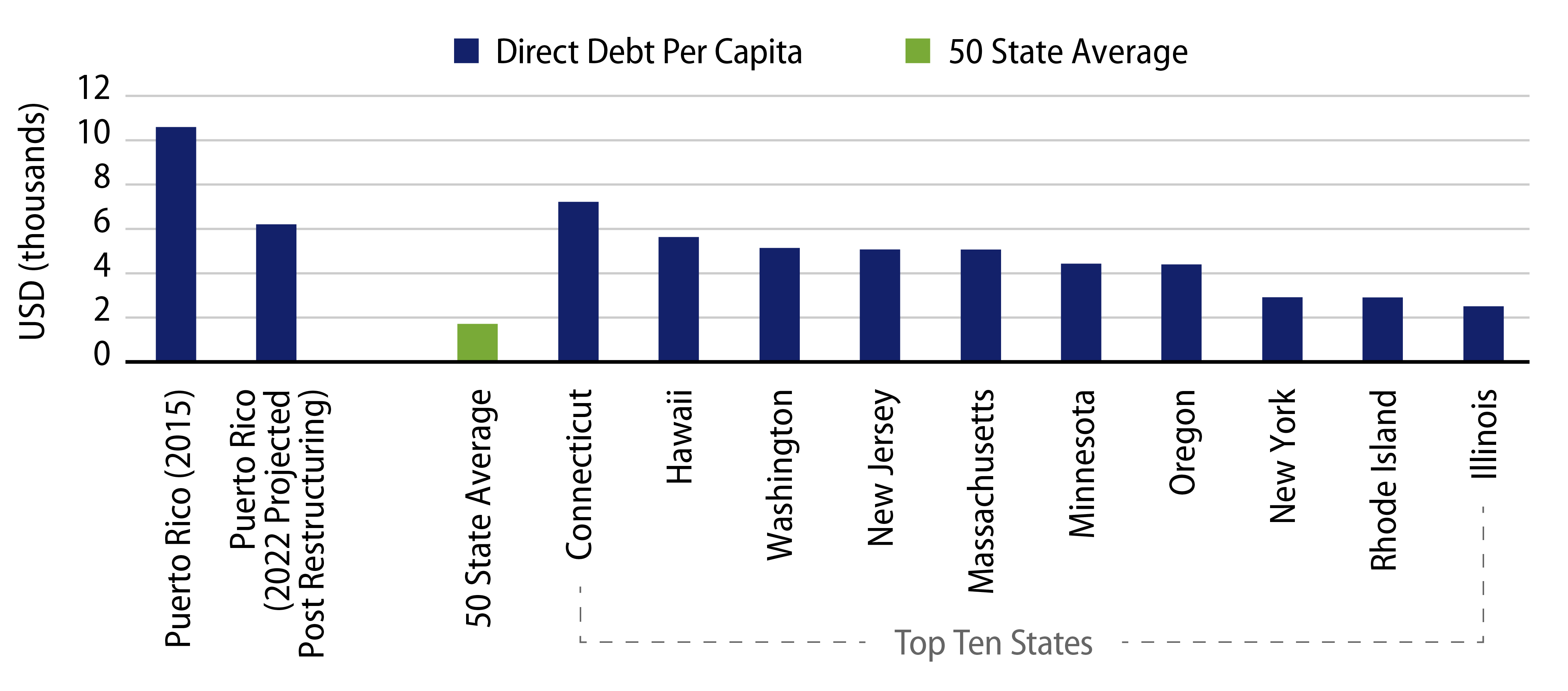

Last week the judge overseeing Puerto Rico’s record municipal bankruptcy process approved its general obligation (GO) and public authority restructuring plan, reducing GO and Public Building Authority debt by 60%, from $18.8 billion to $7.4 billion.

GO and Public Building Authority bondholder recoveries will range from 68% to 78%, and will be comprised of both new bonds and a cash component. Notably, GO debt holders are also entitled to a portion of sales tax collections that are in excess of amounts projected in the certified plan, which could boost recoveries further. Recoveries for Puerto Rico’s Employee Retirement System (ERS) Bonds and Convention Center District Authority debt are relatively lower at 14%.

One of the main sticking points to finalizing the plan was the treatment of retiree benefits. A trust will be established to sustain the pension system, while accrued benefits will be frozen and plans will shift to a defined-contribution approach going forward. The completion of the GO and public authority restructuring also sets the stage for the Puerto Rico Electric Power Authority (PREPA) and the Highway Authority debt reductions to move forward in earnest in the second quarter.

Western Asset believes that the Commonwealth’s exit from its bankruptcy process adds stability to its improving credit complex. In addition, the federal government has and continues to provide the Commonwealth with extraordinary support, considering robust Medicaid, COVID-19 relief and FEMA disaster funding. The island’s longer-term outlook is more clouded and will hinge on the ability to sustain an economic base that can grow over time. However, near-term debt relief under the agreement is a significant step in clearing the path for the island to access the markets, reinvest in its economy, and chart a potentially better future for its residents and bondholders.